net investment income tax 2021 calculator

It is mainly intended for residents of the US. From as high as 478.

Tax Calculator Estimate Your Income Tax For 2022 Free

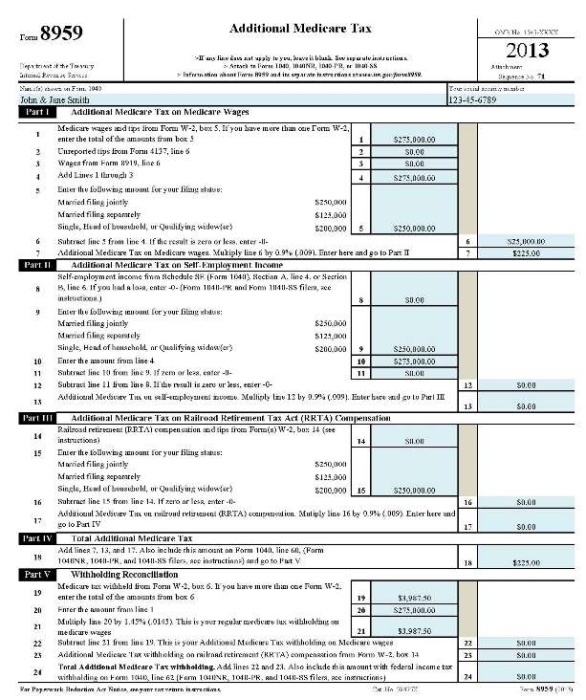

The IRS provides information for this tax benefit in Form 8960 which is used to calculate your total net investment income NII tax for individuals estates and trusts.

. Strategies to Reduce Your Modified Adjusted Gross Income. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. 1 It applies to individuals families estates and trusts but certain income thresholds must be met before the tax takes effect.

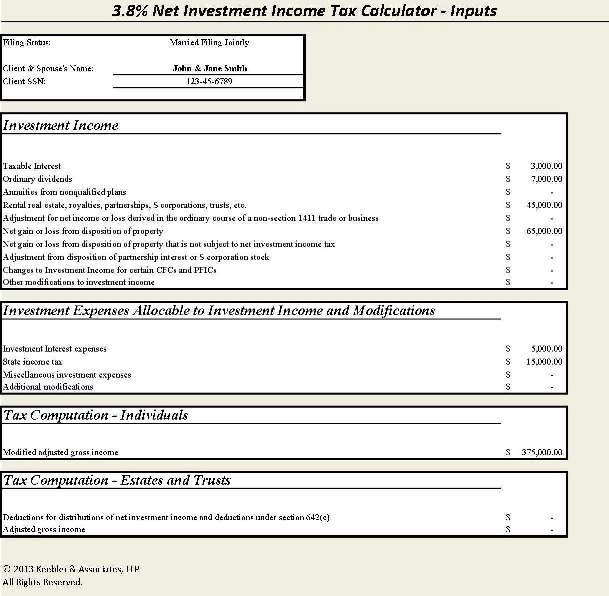

Qualifying widow er with a child 250000. Youll owe the 38 tax. A Married Filing Jointly household has 300000 in income from self-employment and 10000 in dividends.

However you also have 75000 in net investment income from capital gains rental income and dividends which pushes your total income to 275000. Once you are above these income amounts the Net Investment Income Tax goes into effect. You calculate MAGI by adding AGI plus.

But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. April 28 2021 The 38 Net Investment Income Tax.

A the undistributed net investment income or. 2019 Tax Bracket for Estate. For more information on the Net Investment Income Tax refer to Tax filing FAQ.

Your net investment income is less than your MAGI overage. Given the complexity of the 38 tax if this tax is applicable for you based on the guidelines above we encourage. B the excess if any of.

Net Investment Income Tax 2021 Bracket. 1 net investment income or 2 magi in excess of 200000 for single filers or head of households 250000 for married couples filing. A 1000 deduction can only reduce net taxable income by.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The net investment income tax calculator is for a person who has modified adjusted gross income more than the threshold and also investment income. The net investment income tax shouldnt be an everyday or every year thing it applies to investment income above a.

Overview Data and Policy Options Since 2013 certain higher-income individuals have been. Foreign earned income exclusion and certain foreign investment adjustments. All of the dividends will be taxed at 38 for a total of 380.

Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. Because your income is now 25000 past the threshold and that number is the lesser of 75000 your total net investment income then you would owe taxes on that 25000. To calculate the NIIT lets first look at the statutory threshold amounts.

The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. Distribution of Net Investment Income Tax 2018 Adjusted Gross Income Share of Returns with. Internal Revenue Code Simplified A Tax Guide That Saves You Money.

You then enter your NIIT liability on the appropriate line of your tax form and file Form. To as low as 000. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

We do not calculate the potential tax consequence. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Net investment income can be capital gains interest or dividends.

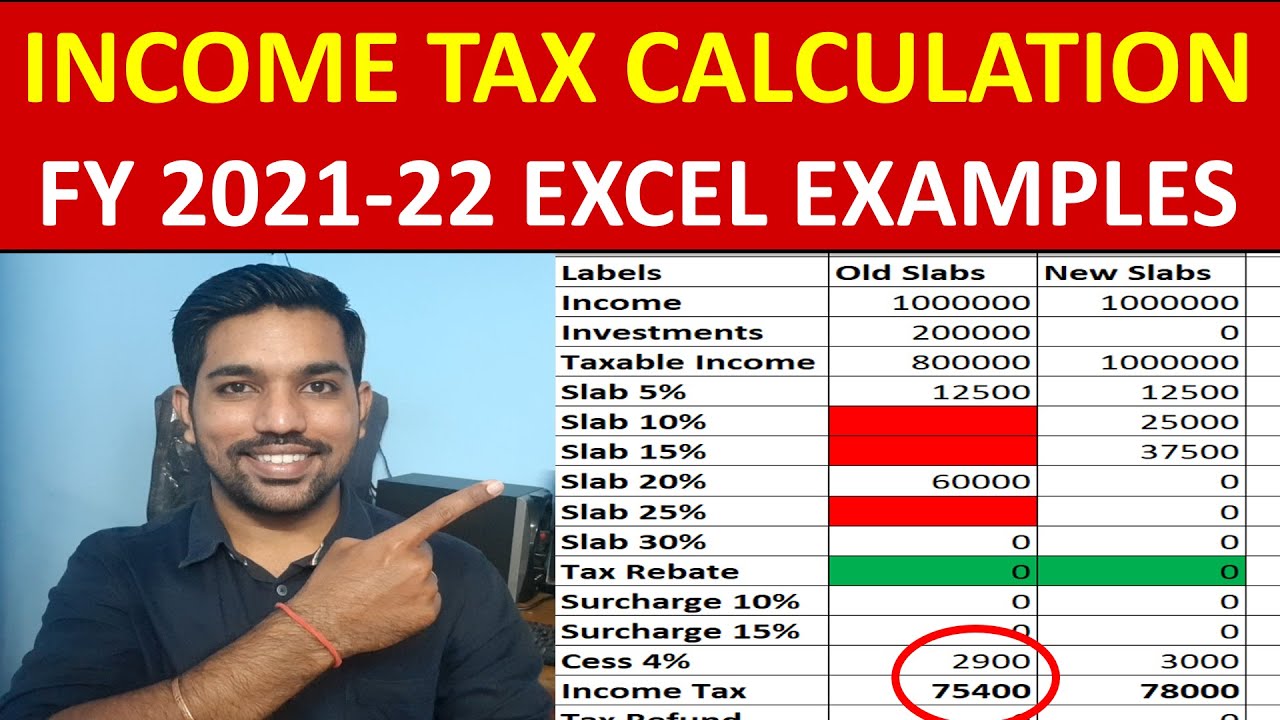

Additionally health and education cess at 4 are levied on the total tax rate above the total amount payable. For estates and trusts the 2021 threshold is 13050. Your tax rate on realized investment return and retirement account withdrawals varies.

For example- for the financial year 2021-22 the net taxable income is Rs 1200000 and the total tax payable is Rs 119000. Your additional tax would be 1140 038. Married filing jointly 250000 Married filing separately 125000 Single or head of household 200000 or.

In the case of an estate or trust the NIIT is 38 percent on the lesser of. This same couple realizes an additional 100000 capital gain for total AGI of 350000. Long Term Capital.

The formula for calculating tax percentage is total tax payable divided by the total net taxable income for the financial year. Withdrawals before age 59½ are generally subject to an additional 10 federal tax and may be subject to additional state and local tax the impact of which is not shown. These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are determined.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income.

Net investment income NII tax. Apr 15 2021. If your net investment income is 1 or more Form 8960 helps you calculate the NIIT you owe by multiplying the amount by which your MAGI exceeds the applicable threshold or your net investment incomewhichever is the smaller figureby 38 percent.

Income Tax Return for Estates and Trusts Schedule G Line 4. Qualifying widow er with a child 250000. Generally net investment income includes gross income from interest dividends annuities and royalties.

We are only required by the IRS to indicate annuity distributions. The investment income above the 250000 NIIT threshold is taxed at 38. The estates or trusts portion of net investment income tax is calculated on Form 8960 Net Investment Income TaxIndividuals Estates and Trusts and is reported on Form 1041 US.

Advanced retirement calculator and much more. If you had 50000 of taxable income in 2021 as a single filer youre going to pay 10 on that first 9950 and 12 on the chunk of income between 9951 and 40525 and so on -. The net investment income tax applies to taxpayers who have a significant amount of investment income typically high-net-worth families and individuals with considerable assets.

And is based on the tax brackets of 2021 and 2022.

How To Calculate The Net Investment Income Properly

2021 Estate Income Tax Calculator Rates

What You Need To Know About Capital Gains Tax

Net Investment Income Tax Calculator The Ultimate Estate Planner Inc

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What Is The The Net Investment Income Tax Niit Forbes Advisor

Net Investment Income Tax Calculator The Ultimate Estate Planner Inc

Obamacare Investment Tax Problem For High Income Earners

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

How To Calculate The Net Investment Income Properly

Capital Gains Tax Calculator 2022 Casaplorer

How To Calculate The Net Investment Income Properly

Net Investment Income Tax Calculator The Ultimate Estate Planner Inc

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

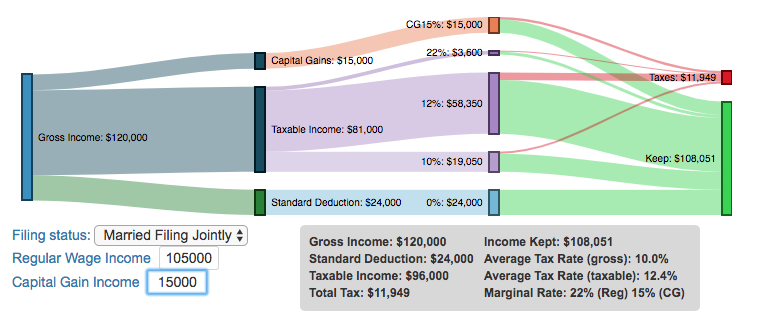

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)